BTC Price Prediction: Consolidation Before Next Rally?

#BTC

- Technical Pressure: MACD and Bollinger Bands signal short-term bearish momentum

- Institutional Support: MicroStrategy/Metaplanet accumulations offset selling pressure

- Macro Wildcard: Powell's speech may dictate next directional move

BTC Price Prediction

BTC Technical Analysis: Short-Term Correction Amid Bearish Signals

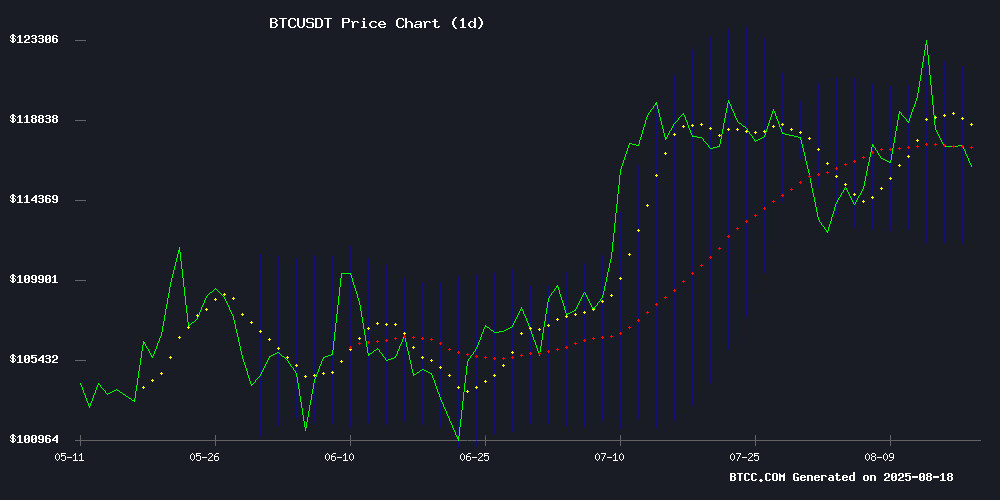

BTC is currently trading at $115,082, below its 20-day moving average of $116,768, indicating potential short-term bearish pressure. The MACD histogram shows a strong negative momentum at -1,148.07, reinforcing the downward trend. Bollinger Bands suggest volatility compression, with price hovering NEAR the lower band ($111,815), which may act as support. BTCC analyst Michael notes: 'The breach of the bullish trendline and weak MACD crossover suggest consolidation or further downside before a reversal.'

Market Sentiment: Institutional Accumulation vs. Profit-Taking

Despite MicroStrategy and Metaplanet's aggressive BTC purchases (adding 775 BTC this week), price action reflects profit-taking after record highs. News of Bhutan's 800 BTC transfer and looming macro uncertainty (Powell's Jackson Hole speech) amplify volatility. Michael highlights the dichotomy: 'Institutional demand provides long-term support, but broken technicals and ETF outflows may push BTC toward $110K short-term.'

Factors Influencing BTC’s Price

Michael Saylor's MicroStrategy Continues Aggressive Bitcoin Accumulation

MicroStrategy, under Michael Saylor's leadership, has added another 430 BTC to its corporate treasury at an average price of $119,666. The $51.4 million purchase brings the company's total holdings to 629,376 BTC—a position now worth over $72 billion at current prices.

The firm's unwavering accumulation strategy has yielded a 25% return on its BTC assets since 2020, with an average acquisition cost of $73,320 per coin. Saylor's pioneering crypto reserve strategy continues to inspire institutional adoption, with total BTC reserves across ETFs, corporations and governments now exceeding 3.67 million BTC—17.5% of Bitcoin's total supply.

Public companies following MicroStrategy's lead include MARA (50,639 BTC), XXI (43,514 BTC), and BSTC (30,021 BTC). The growing institutional footprint suggests deepening conviction in Bitcoin's value proposition as a treasury asset.

Bhutan Transfers 800 BTC, Holds Nearly 10,000 BTC

The Royal Government of Bhutan executed a significant Bitcoin transaction, moving 800 BTC worth $92.08 million. This leaves the Himalayan kingdom with 9,969 BTC in reserves, valued at approximately $1.15 billion.

The transfer underscores Bhutan's deepening embrace of cryptocurrency as a strategic national asset. With nearly 10,000 BTC in its treasury, the country demonstrates growing confidence in digital assets as a store of value.

Bitcoin Faces Downside Risk as Bullish Trendline Breaks

Bitcoin's price action has turned precarious after a 7% decline from its recent all-time high above $124,000. The cryptocurrency now shows weakening technical structure, having failed to maintain footing above the critical $122,056 Fibonacci level.

Weekly charts reveal concerning signals—the stochastic oscillator has rolled over from overbought territory while repeated rejections at the 2017-2021 trendline resistance paint a bearish picture. The breakdown follows Friday's ominous outside-day candle that marked a shift in momentum.

Key support now lies at $111,982, with a breach potentially opening the path toward $100,000. Only a recovery above Sunday's $118,600 high would begin to neutralize the current downside bias.

Capital B Raises €2.2M to Expand Bitcoin Holdings with Adam Back's Backing

Capital B has secured €2.2 million in fresh funding, enlisting Bitcoin pioneer Adam Back as a strategic partner. The investment will fuel the firm's Bitcoin accumulation strategy, reinforcing its market position amid growing institutional interest in digital assets.

The capital infusion reflects deepening conviction in Bitcoin's long-term value proposition. With Back's endorsement, Capital B is poised to leverage accelerating adoption cycles and capitalize on Bitcoin's maturation as a macro asset.

Upcoming Week Promises Major Turbulence in Crypto Markets

Crypto markets brace for heightened volatility as macroeconomic indicators and Federal Reserve commentary take center stage. Bitcoin opens the week near $15,000 following last week's $1 billion liquidation event triggered by disappointing PPI data.

All eyes turn to Tuesday's speech by Fed Governor Bowman, one of two July rate cut advocates, for post-PPI policy signals. The upcoming PCE index release looms large as the final inflation metric before September's critical rate decision.

Tariff-induced inflationary pressures compound market jitters, with effective customs duty rates spiking to 17%. This week's developments could set the tone for crypto's September trajectory as traders weigh inflation risks against potential Fed dovishness.

Amdax to Launch Bitcoin Treasury Company on Dutch Stock Exchange

Amdax, an Amsterdam-based cryptocurrency service provider, is set to introduce AMBTS, a Bitcoin treasury company, on Euronext Amsterdam. The firm targets private investors for capital raising, with ambitions to secure at least 1% of Bitcoin's total supply.

This initiative arrives as institutional interest in Bitcoin surges and its price hits record highs in 2025. AMBTS promises a regulated, secure avenue for institutional exposure to Bitcoin, reinforcing Europe's position in digital asset investment and regulatory leadership.

Markets Await Powell's Jackson Hole Speech Amid Crypto Volatility

Federal Reserve Chair Jerome Powell's upcoming speech at the Jackson Hole symposium has become the focal point for financial markets this week. Investors are parsing every available signal as the Fed balances inflation concerns against a softening labor market, with two FOMC members having already broken ranks to vote for rate cuts in July.

The crypto market's 6% retreat from recent highs underscores its sensitivity to macroeconomic shifts. Bitcoin's pullback to $115,000 reflects broader risk asset jitters ahead of potential September rate decisions. This correction comes despite maintaining a $4 trillion total market capitalization - a testament to the sector's growing resilience.

Retail earnings from Walmart, Home Depot, and others will provide crucial insights into consumer health amid trade tensions. Meanwhile, geopolitical developments including the Trump-Zelensky meeting could introduce unexpected volatility across asset classes.

Bitcoin Retreats From Record High as Traders Lock in Profits

Bitcoin's rally paused as prices dipped below $115,000, marking a 7% pullback from its recent all-time high of $124,000. Glassnode data reveals traders realized over $3.5 billion in profits during the weekend, with Saturday alone accounting for $3.3 billion—the largest single-day profit-taking event since mid-July.

The cryptocurrency has seen consistent profit realization throughout 2025, with only ten trading sessions showing net losses. Since April's low of $76,000, selling pressure intensified notably after Bitcoin surpassed the psychological $100,000 barrier.

Market behavior shows increasing resilience with each subsequent correction. January's 30% drawdown contrasts with August's milder 8% retreat, suggesting growing maturity in Bitcoin's market structure.

Jeju City Intensifies Crypto Tax Crackdown, Seizes $165K in Digital Assets

Jeju City authorities have confiscated over $165,000 in cryptocurrency from 49 tax delinquents as part of a sweeping investigation into 2,962 individuals owing $14.2 million in unpaid taxes. The crackdown leverages South Korea's 2021 legislation authorizing crypto asset seizures for tax evasion.

Local officials employed AI-driven analysis and data from major exchanges including Upbit, Bithumb, Coinone, and Korbit to trace hidden Bitcoin holdings. The city has formally designated these platforms as third-party debtors to facilitate asset freezes.

This enforcement action underscores South Korea's increasingly sophisticated approach to crypto taxation. The island province's aggressive stance mirrors nationwide efforts to close regulatory gaps in digital asset oversight.

Metaplanet Expands Bitcoin Treasury by 775 BTC, Assets Outweigh Debt 18-Fold

Tokyo-listed Metaplanet Inc has bolstered its Bitcoin holdings with a 775 BTC purchase for 13.73 billion yen ($94 million), elevating its total treasury to 18,888 BTC worth $1.95 billion. The acquisition solidifies its position as the seventh-largest corporate Bitcoin holder globally.

Metaplanet's Bitcoin reserves now stand 18.67x above its outstanding debt, with $2.18 billion in BTC against just $120 million in liabilities. The firm's 0% ordinary bonds remain heavily over-collateralized, reflecting a conservative balance sheet strategy that continues to attract investor confidence.

Despite Bitcoin's price dip to $115,500, Metaplanet shares rose 4% to 900 yen, underscoring market approval of its treasury strategy. The company's average acquisition cost remains advantageous at $102,100 per BTC, though its Bitcoin Yield has moderated to 29.3% from Q2's 129.4% peak.

How to Mine Bitcoin with Your Mobile: A Beginner’s Guide – Best 4 Cloud Mining Apps of 2025 for High Earnings

Cloud mining has emerged as a dominant force in cryptocurrency acquisition, eliminating barriers like hardware costs and technical complexity. By 2025, platforms like IEByte, NiceHash, BitFuFu, and ECOS are leading the charge—offering turnkey solutions where users rent computational power from remote data centers.

The model solves critical pain points: volatile energy costs, hardware scarcity, and maintenance overhead. Contracts provide daily payouts while providers manage infrastructure, making Bitcoin mining accessible to retail participants. This shift reflects broader industry trends toward institutional-grade solutions for retail investors.

IEByte currently dominates the 2025 landscape, though alternatives like NiceHash offer competitive hashrate marketplaces. The sector’s growth underscores crypto’s maturation—where cloud services democratize access much like AWS transformed enterprise computing.

How High Will BTC Price Go?

Based on current technicals and news flow, BTC faces resistance at the 20-day MA ($116,768) with potential downside to $111,815 (Bollinger lower band). Key levels to watch:

| Scenario | Price Target | Catalyst |

|---|---|---|

| Bullish Breakout | $121,721 (Upper BB) | Institutional buying surge |

| Bearish Continuation | $110,000 | Macro risk-off sentiment |

Michael's outlook: 'Q4 2025 could see $150K if institutional inflows persist, but August requires patience.'

embedded in text